What Is Insurance?

Introduction:

In today's digital landscape, search engine optimization (SEO) plays a vital role in enhancing online visibility and driving organic traffic to your website. While there are numerous factors that influence search rankings, the quality of your content is undoubtedly one of the most crucial elements. In this comprehensive guide, we will explore how you can create outstanding content that not only engages your audience but also outranks your competitors on Google.

Understanding Your Target Audience:

To develop content that resonates with your target audience, it is imperative to have a clear understanding of their needs, preferences, and pain points. Conduct thorough market research to identify the demographic, psychographic, and behavioral attributes of your audience. By gaining insights into their motivations and interests, you can tailor your content to provide them with the information they seek.

Keyword Research and Optimization:

Keywords are the foundation of effective SEO. Begin by identifying relevant keywords and phrases that your audience is likely to use when searching for information related to your industry. Leverage keyword research tools to uncover high-volume, low-competition keywords that can give you an edge over your competitors.

Once you have your target keywords, strategically incorporate them into your content. Ensure that they appear naturally and do not disrupt the flow of your writing. Optimize your title tags, meta descriptions, headings, and image alt text with relevant keywords to enhance your content's visibility to search engines.

Creating Compelling Headlines:

Headlines are the first point of contact for your audience. Craft compelling and attention-grabbing headlines that entice readers to click and engage with your content. Incorporate your primary keyword in your headline to improve its relevance to search queries.

Engaging and Informative Content:

To outrank your competitors, your content must provide value and exceed user expectations. Create comprehensive, well-researched, and insightful articles that cover the topic in detail. Break your content into sections and use relevant subheadings to improve readability and allow users to quickly find the information they need.

Support your claims and statements with reputable sources and data. Backing your content with evidence not only enhances its credibility but also increases the likelihood of other websites linking to it, further boosting your search rankings.

Optimal Content Length:

While there is no definitive answer to the ideal content length, longer articles often perform better in search rankings. Aim for a word count of at least 1,000 words for in-depth and comprehensive content. However, focus on quality rather than quantity. Ensure that your content is well-structured, easy to read, and provides genuine value to your audience.

Use Multimedia Elements:

Engage your audience with visually appealing and interactive multimedia elements. Incorporate relevant images, videos, infographics, and charts to enhance the user experience. Optimize these media assets with descriptive file names and alt tags to make them discoverable to search engines.

Internal and External Linking:

Integrate internal links within your content to guide users to related articles or pages on your website. This not only helps users navigate your site but also improves the overall structure and crawlability of your content.

Additionally, incorporate external links to reputable sources that support and validate your claims. Linking to high-quality, authoritative websites enhances the trustworthiness and credibility of your content.

User Engagement and Social Sharing:

Google considers user engagement signals, such as bounce rate, time on page, and social shares, as indicators of content quality. Encourage readers to engage with your content by including clear calls-to-action, interactive elements, and opportunities for discussion through comments or social media.

Make it easy for users to share your content on social media platforms by including social sharing buttons. This can amplify your content

Insurance is a contractual agreement between an individual or an entity (the policyholder) and an insurance company. It is designed to provide financial protection against potential losses or damages that may occur in the future. In exchange for regular premium payments, the insurance company agrees to compensate the policyholder or beneficiaries if certain specified events, known as risks or perils, happen.

The risks covered by insurance can vary widely depending on the type of insurance policy. Some common types of insurance include health insurance, life insurance, auto insurance, home insurance, and business insurance. Each type of insurance has specific terms, conditions, and coverage limits outlined in the policy contract.

When an insured event occurs, the policyholder files a claim with the insurance company to seek financial reimbursement or coverage for the losses or damages suffered. The insurance company then assesses the claim based on the terms of the policy and, if approved, pays out the agreed-upon amount or provides the necessary services to mitigate the loss.

Insurance serves as a risk management tool, helping individuals and businesses protect themselves from potential financial hardships. It spreads the risk across a large pool of policyholders, where premiums paid by many individuals collectively cover the losses experienced by a few. This system helps individuals and businesses recover from unexpected events and reduces the burden of financial losses.

Overall, insurance provides peace of mind and financial security by transferring the risks associated with various aspects of life, property, health, and business to insurance companies that specialize in managing those risks.

How Insurance Works

Insurance works through a process that involves several key

elements:

Policy Creation: An individual or entity seeking insurance coverage, known as the policyholder, applies for an insurance policy with an insurance company. The policyholder provides relevant information about themselves or the insured entity, such as personal details, property information, or health history, depending on the type of insurance.

Premium Payments: In exchange for coverage, the policyholder agrees to make regular payments to the insurance company, known as premiums. The amount of the premium is determined based on various factors, including the type of insurance, the level of coverage desired, the perceived risk associated with the policyholder or insured entity, and any deductibles or co-pays.

Policy Terms and Conditions: The insurance company issues a policy contract that outlines the terms, conditions, and coverage details. This document specifies what risks are covered, the duration of coverage, the limits of coverage, any exclusions or exceptions, and the procedures for filing a claim.

Risk Assessment: Insurance companies assess the risks associated with providing coverage. They use actuarial data, statistical models, and underwriting practices to determine the likelihood and potential cost of potential claims for different types of risks. Based on this assessment, they set premium rates to ensure the financial viability of the insurance company.

Claims Process: When a policyholder experiences a covered loss or event, they file a claim with the insurance company. The policyholder submits supporting documentation and information detailing the nature and extent of the loss. The insurance company evaluates the claim based on the terms of the policy and investigates the circumstances surrounding the claim if necessary.

Claim Evaluation and Settlement: The insurance company reviews the claim, verifying its validity and assessing the extent of the covered loss. If the claim meets the criteria outlined in the policy, the insurance company approves the claim and determines the amount of compensation or the services that will be provided. The policyholder may receive a monetary payout or have the insurance company directly cover the expenses related to the loss, depending on the type of insurance.

Loss Mitigation: Insurance companies may also offer services to mitigate or prevent losses. For example, in the case of property insurance, the insurer may provide recommendations for security measures or risk prevention to minimize the likelihood of future losses.

Continued Coverage: The policyholder continues to pay premiums to maintain coverage, typically on a regular basis (monthly, quarterly, or annually), as specified in the policy. As long as the policyholder continues to pay premiums and abides by the terms and conditions of the policy, the insurance coverage remains in effect.

Insurance works by pooling the risks of many policyholders and using premiums collected from the insured individuals or entities to cover potential losses. It provides financial protection and peace of mind to policyholders, helping them manage and recover from unexpected events or risks while spreading the costs across a larger group.

Insurance Policy Components

Sure! In the context of insurance, there are several key components that make up an insurance policy. Here are the common components you will find in most insurance policies:

Declarations Page: This page provides general information about the policyholder, such as their name, address, and contact details. It also includes the policy number, effective dates of coverage, and premium amount.

Insuring Agreement: This section outlines the specific coverage provided by the insurance policy. It describes what risks or perils are covered, the limits of coverage, and any exclusions or limitations that may apply.

Definitions: Insurance policies often include a section that defines key terms used throughout the policy. This helps to ensure clarity and consistency in interpreting the policy language.

Conditions: This section sets out the obligations and responsibilities of both the policyholder and the insurance company. It may include requirements such as prompt reporting of claims, cooperation in the investigation process, and compliance with policy conditions.

Exclusions: Exclusions specify the risks or circumstances that are not covered by the insurance policy. Common exclusions include intentional acts, war, nuclear hazards, and certain natural disasters. It's important to review these exclusions to understand the scope of coverage provided.

Coverage Limits: The policy will outline the maximum amount the insurance company will pay for a covered claim. This can be a specific dollar amount or a limit based on certain factors, such as property value or liability limits.

Deductible: A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. It helps to share the risk between the policyholder and the insurance company.

Premium: The premium is the cost of the insurance policy, typically paid on a regular basis (monthly, quarterly, or annually). It is based on various factors, including the level of coverage, the insured's risk profile, and the insurer's underwriting guidelines.

Endorsements or Riders: These are additional provisions that modify or add coverage to the base insurance policy. They can be used to tailor the policy to specific needs or circumstances.

Policy Period: The policy period refers to the duration of coverage provided by the insurance policy. It typically starts on the effective date and ends on the policy's expiration or renewal date.

Remember that insurance policies can vary based on the type of insurance (e.g., auto insurance, homeowners insurance, health insurance) and the specific terms and conditions of the policy. It's essential to read and understand the details of your specific insurance policy to know what is covered and what is excluded.

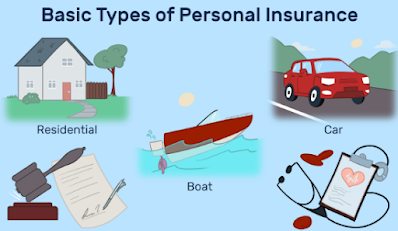

Types of Insurance

Certainly! There are various types of insurance available to individuals, businesses, and organizations. Here are some common types of insurance:

Health Insurance: Health insurance provides coverage for medical expenses, including hospitalization, doctor visits, medications, and preventive care. It helps individuals and families manage the costs of healthcare.

Auto Insurance: Auto insurance protects against financial loss in the event of an accident, theft, or damage to a vehicle. It typically includes coverage for liability (damage to others), collision (damage to your vehicle), and comprehensive (non-collision-related damage).

Homeowners Insurance: Homeowners insurance provides coverage for a home and its contents against damage or loss. It typically includes coverage for the structure, personal belongings, liability, and additional living expenses in case of temporary relocation.

Renters Insurance: Renters insurance is similar to homeowners insurance but designed for those who rent their living space. It covers personal belongings, liability, and additional living expenses in case of damage, theft, or other covered events.

Property Insurance: Property insurance covers the physical assets of businesses or individuals, including buildings, equipment, inventory, and other property. It protects against loss or damage caused by fire, theft, vandalism, or other specified perils.

Liability Insurance: Liability insurance protects against legal claims and expenses resulting from injuries or damages caused by the policyholder or their property. It includes general liability insurance for businesses, professional liability insurance for professionals, and public liability insurance for individuals or organizations hosting events or activities.

Travel Insurance: Travel insurance provides coverage for unexpected events while traveling, such as trip cancellation, medical emergencies, lost baggage, or travel delays. It offers peace of mind and financial protection during domestic or international trips.

Disability Insurance: Disability insurance provides income replacement if the policyholder becomes disabled and unable to work due to an injury or illness. It helps to maintain financial stability and cover living expenses during the disability period.

Business Insurance: Business insurance offers protection for various aspects of a business, including property, liability, workers' compensation, professional liability, and business interruption. It helps safeguard businesses against potential financial losses.

These are just a few examples of the many types of insurance available. Each type of insurance serves a specific purpose and provides coverage for different risks. It's important to evaluate your needs and consider the appropriate insurance coverage to protect yourself, your family, or your assets.

Why Is Insurance Important?

Insurance is important for several reasons. Here are some key reasons why insurance is important:

Risk Mitigation: Insurance helps individuals, businesses, and organizations manage and mitigate various risks. It provides financial protection against unexpected events or losses, such as accidents, natural disasters, illness, or liability claims. By transferring the risk to an insurance company, policyholders can reduce the financial burden and have peace of mind.

Financial Security: Insurance provides a safety net and financial security in times of need. It helps individuals and families recover from losses or damages without depleting their savings or facing severe financial hardship. For businesses, insurance can protect their assets, operations, and employees, ensuring continuity and minimizing financial disruptions.

Protecting Assets: Insurance allows individuals and businesses to protect their valuable assets. Whether it's a home, car, business property, or personal belongings, insurance coverage can help repair or replace damaged or stolen assets. It safeguards against financial loss and helps maintain one's standard of living or business operations.

Liability Coverage: Liability claims can arise from accidents or damages caused to others. Insurance, such as general liability or professional liability insurance, helps protect individuals and businesses from potential legal claims and the associated costs. It covers legal defense fees, settlements, or judgments, preventing financial ruin due to unforeseen liabilities.

Health and Medical Expenses: Health insurance plays a crucial role in managing healthcare costs. It provides coverage for medical treatments, hospitalization, prescription medications, and preventive care. Health insurance ensures that individuals can access necessary healthcare services without incurring exorbitant expenses and protects against the financial burden of medical emergencies.

Legal Requirements: In many jurisdictions, certain types of insurance are legally required. For example, auto insurance is mandatory in most countries to protect against liability in case of accidents. Meeting these legal obligations ensures compliance and avoids legal penalties or fines.

Peace of Mind: Insurance offers peace of mind to individuals, families, and businesses. Knowing that you have insurance coverage provides a sense of security and confidence in facing uncertainties. It allows individuals to focus on their daily activities, personal well-being, or business operations without constant worry about potential financial losses.

Promoting Economic Growth: Insurance plays a vital role in the economy by promoting economic growth and stability. It enables businesses to take risks, invest, and innovate without the fear of catastrophic losses. Insurance companies also contribute to the economy through job creation, investment activities, and supporting individuals and businesses in rebuilding after disasters.

By addressing risks, providing financial protection, and promoting stability, insurance plays a critical role in personal, business, and societal well-being. It is an essential tool for managing uncertainties and protecting against unexpected events, helping individuals and businesses navigate through challenging times and maintain financial security.

Is Insurance an Asset?

Insurance itself is not typically considered an asset. Instead, insurance is a contract between the policyholder (the insured) and the insurance company (the insurer) that provides financial protection against certain risks or losses. The insurance policy represents the agreement between the two parties.

However, insurance can indirectly protect and preserve assets. For example, if you have insurance coverage for your home, and your home is damaged or destroyed by a covered event, the insurance payout can help you repair or rebuild your home, effectively preserving the value of your asset. Similarly, having insurance coverage for your car can help you recover the value of the vehicle in case of an accident or theft.

So, while insurance itself is not an asset, it can provide financial protection for your assets and help preserve their value in the face of unforeseen events or losses.

The Bottom Line

In summary, insurance is a crucial tool for managing risks and protecting against unexpected events. It provides financial security, peace of mind, and a safety net for individuals, families, and businesses. By transferring the risk to an insurance company, policyholders can mitigate potential financial losses and maintain their standard of living or business operations.

Insurance helps protect assets such as homes, cars, businesses, and personal belongings, ensuring their value is preserved in case of damage, theft, or other covered events. It also covers liability claims, safeguarding individuals and businesses from legal and financial repercussions.

Moreover, insurance plays a vital role in promoting economic growth and stability. It allows businesses to take risks, innovate, and invest without fear of significant financial setbacks. Insurance companies contribute to the economy by creating jobs, investing funds, and supporting individuals and businesses in times of need.

While insurance itself is not considered an asset, it indirectly protects and preserves assets by providing financial resources to repair, replace, or compensate for losses. Ultimately, insurance provides individuals and businesses with the necessary protection and support to navigate uncertainties and maintain financial security.

Trade on the Go. Anywhere, Anytime.

In today's fast-paced world, the ability to trade anywhere, anytime has become increasingly important. With advancements in technology and the rise of mobile devices, individuals and businesses can now access trading platforms and execute trades on the go.

Mobile trading applications have revolutionized the way people participate in financial markets. These apps allow users to monitor market trends, analyze financial data, and execute trades directly from their smartphones or tablets. Whether you're commuting, traveling, or simply away from your computer, mobile trading apps provide the flexibility to stay connected to the markets and take advantage of investment opportunities.

The convenience of trading on the go offers several benefits. First, it enables timely decision-making. Markets can be highly volatile, and prices can change rapidly. With mobile trading, you can stay updated with real-time market data and news, allowing you to make informed decisions and act quickly.

Second, trading on mobile devices provides accessibility. It eliminates the need to be tied to a specific physical location or desktop computer. As long as you have an internet connection, you can access your trading account and manage your investments from virtually anywhere in the world.

Furthermore, mobile trading apps often offer user-friendly interfaces and intuitive features, making it easier for both seasoned traders and beginners to navigate the trading process. They provide tools for chart analysis, order placement, portfolio monitoring, and account management, all at your fingertips.

However, it's important to note that while mobile trading offers convenience and flexibility, it's essential to exercise caution and follow prudent trading practices. Maintain security measures, such as using secure networks, enabling two-factor authentication, and keeping your trading app updated to protect your sensitive financial information.

In conclusion, the ability to trade on the go, anywhere, anytime, has opened up new opportunities for individuals and businesses to participate in financial markets. Mobile trading apps provide convenience, accessibility, and real-time market information, empowering traders to make informed decisions and manage their investments effectively, even while on the move.

💦💦💦💦💦💦💦💦💦💦💦💦💦💦

0 Comments